forexfinviz.com is committed to the highest ethical standards and reviews services independently. Learn How We Make Money

Best Copy Trading Forex Brokers in 2023

Written by Jack

Edited by John

Fact-checked by Joey

forexfinviz.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Forex copy trading — also known as social trading, mirror trading, or auto trading — has been growing in adoption and general popularity for over a decade. Industry information, financial news, and market analysis now all propagate at lightning speed – thanks in part to social media and an increasingly faster web experience.

These factors, together with the power of the crowd and advanced sentiment data, help to power social copy trading platforms, and the popularity of these platforms has soared as investors generate trading signals and enter the market with new positions that people want to copy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is copy trading?

The idea of copy trading is simple: use technology to copy the real-time forex trades (forex signals) of other live investors (forex trading signal providers) you want to follow. This way, every time they trade, you can automatically replicate (copy) their trades in your brokerage account.

Best Forex Brokers for Social Copy Trading

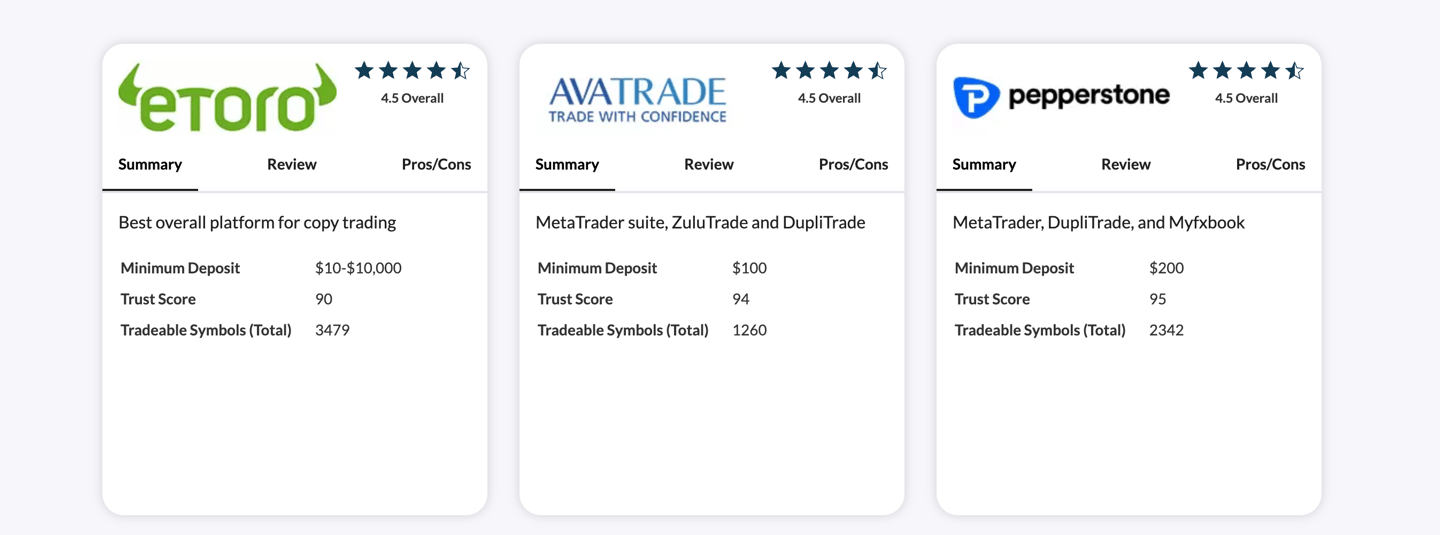

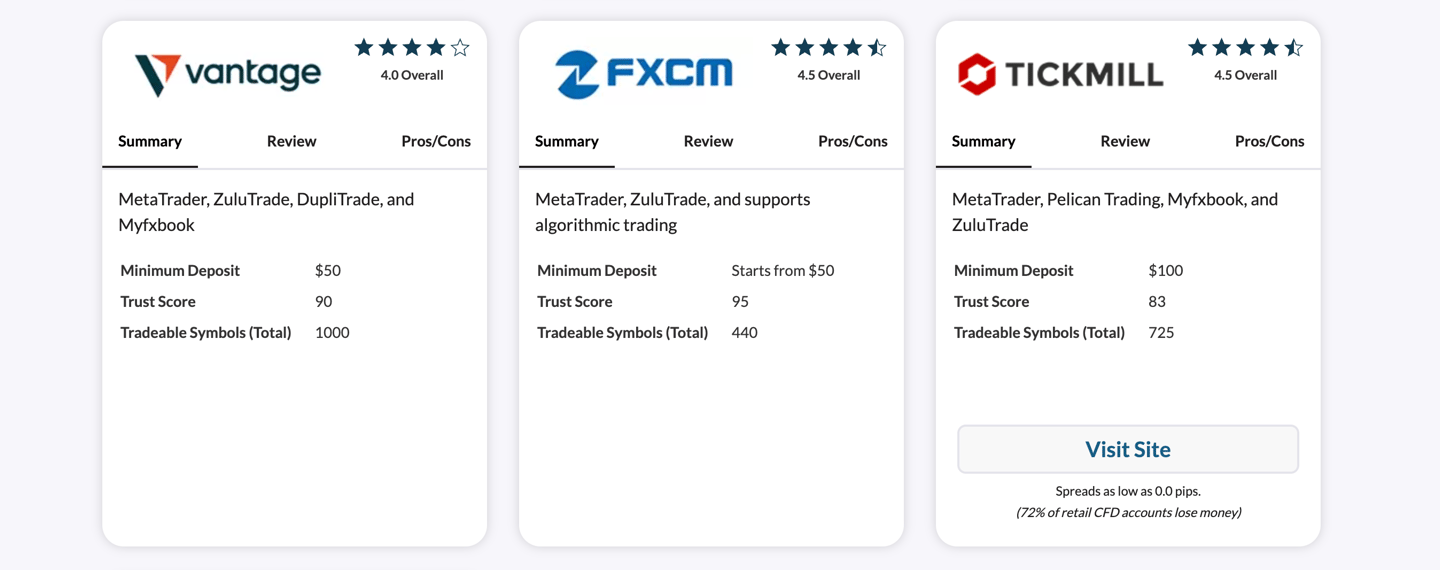

Here are the best forex brokers for copy trading, based on our testing of 39 brokers across 113 variables.

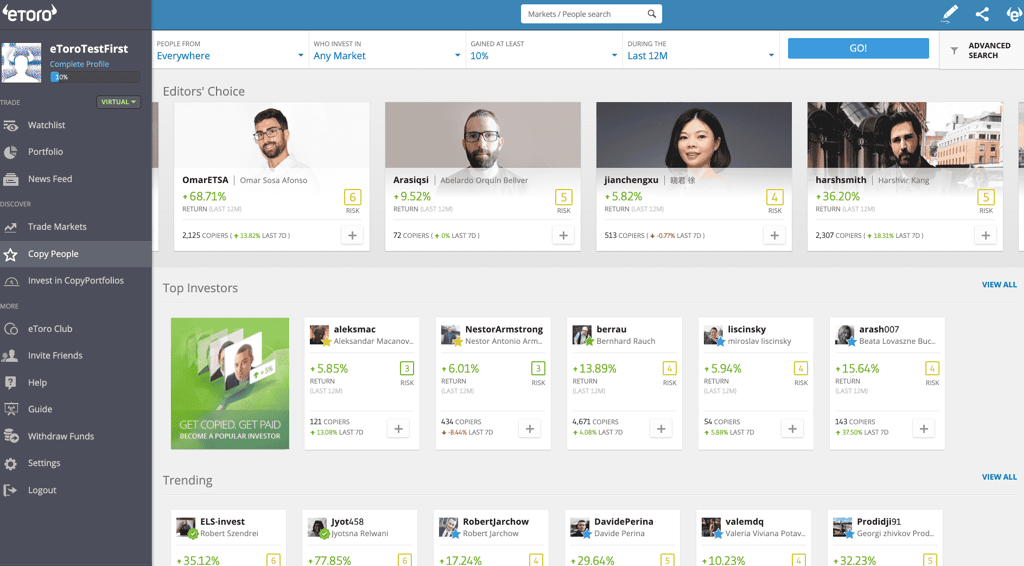

eToro - Best overall platform for copy trading

AvaTrade - MetaTrader suite, ZuluTrade and DupliTrade

Pepperstone - MetaTrader, DupliTrade, and Myfxbook

Vantage - MetaTrader, ZuluTrade, DupliTrade, and Myfxbook

FXCM - MetaTrader, ZuluTrade, and supports algorithmic trading

- MetaTrader, Pelican Trading, Myfxbook, and ZuluTrade

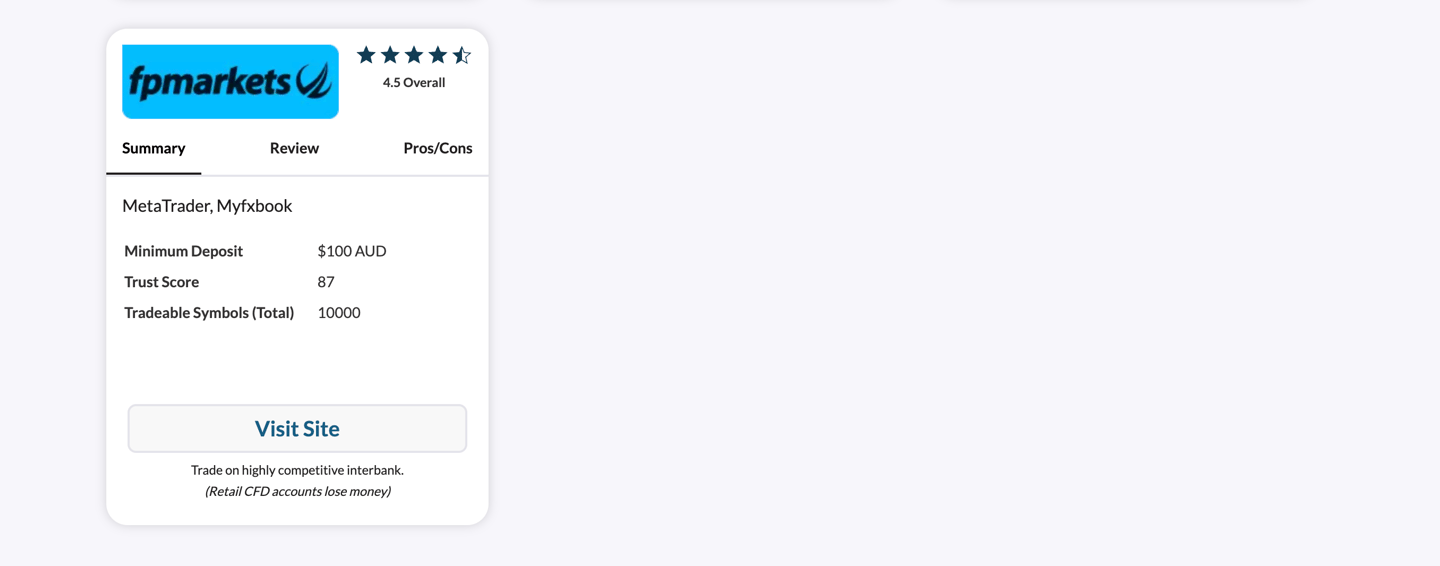

- MetaTrader, Myfxbook

Winner: eToro

eToro is a winner for its easy-to-use copy-trading platform where traders can duplicate the trades of investors across over 2300 instruments, including exchange-traded securities, forex, CFDs, and popular cryptocurrencies.

Trust: eToro was founded in 2007 and is regulated in three Tier-1 jurisdictions and one Tier-4 jurisdiction, earning a Highly Trusted rating for trading forex and CFDs within the forexfinviz.com Trust Score rating system.

Commissions: For trading forex and CFDs, eToro is slightly pricier than most of its competitors, despite recently cutting spreads and introducing zero-dollar commissions for U.S. stock trading.

Copy trading platforms: eToro's main innovation is merging self-directed trading and copy trading under a unified trading experience. It is a winning combination.

Runner-Up: AvaTrade

AvaTrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found AvaTrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a good choice for investor education.

Trust: Founded in 2006, AvaTrade is regulated in four Tier-1 jurisdictions, three Tier-2 jurisdictions, and one Tier-4 jurisdiction. We consider AvaTrade to be Highly Trusted for forex and CFD trading, and AvaTrade's licenses have earned it a Trust Score rating of 94.

Commissions: Compared to pricing leaders such as IG and Saxo Bank, AvaTrade does not rank among the best brokers for low-cost trading, except for clients designated as Professional traders in the EU.

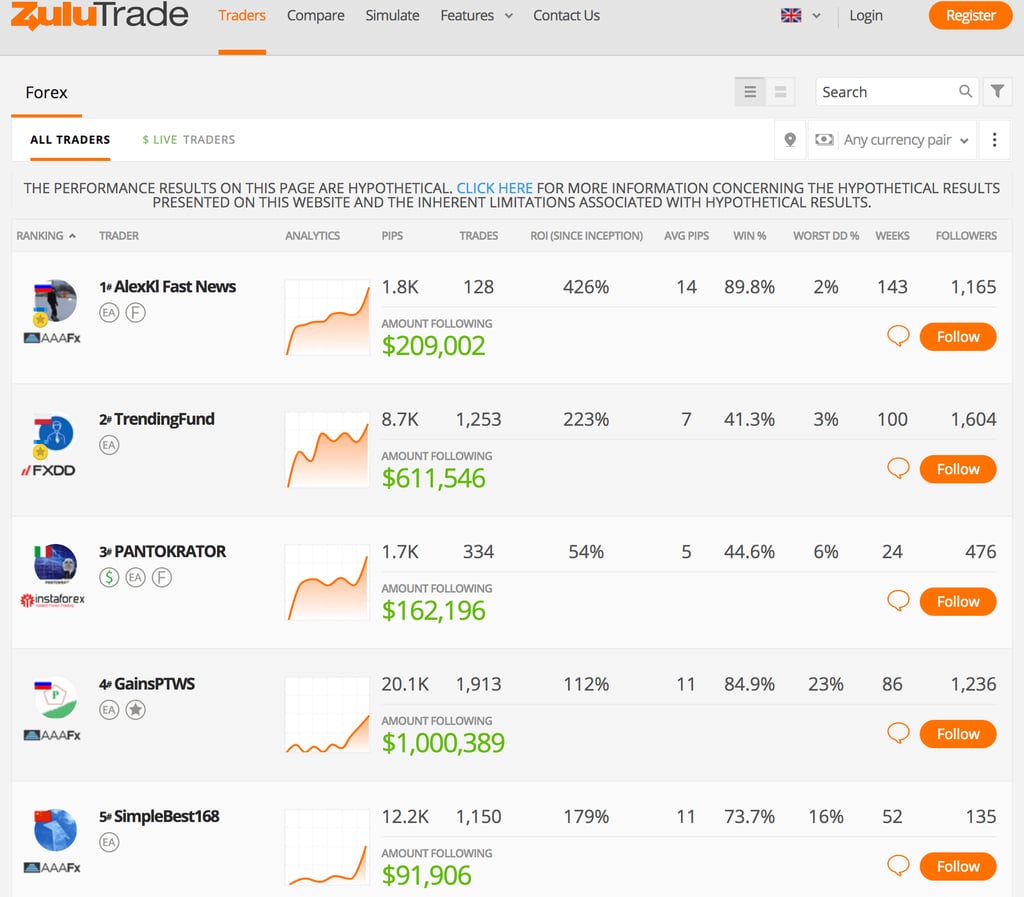

Copy trading platforms: Alongside MetaTrader, AvaTrade offers its proprietary platforms, as well as ZuluTrade and DupliTrade, for social copy trading. The variety of platform options makes AvaTrade competitive in this area.

Copy trading history

Many of the early pioneers in social trading technology started out as third-party platform developers, such as Tradency, ZuluTrade, and eToro. While some of these firms are still independent service providers, or (ISPs), others went in a new direction. eToro, for example, became a broker – check out our full-length eToro review (and our review of eToro’s U.S. stock trading offering at our sister site, StockBrokers.com.

Today, thanks to precise legal definitions and ever-evolving trading technology, regulators in nearly every jurisdiction consider copy trading to be self-directed — because the client must decide who to copy, even if the copying happens automatically (for each signal).

It's important to note that not all trading platforms with social features provide copy trading.

Is copy trading legal?

Copy trading is legal in most countries, as long as the broker itself is properly regulated. When investing in financial markets through a regulated broker, there are procedures in place during the account opening process that should ensure it is legal for you to trade (depending on your country of residence).

Forex Finviz.com

______________

© 2023 Forex Finviz All rights reserved. Terms of Use | Disclaimers | Privacy Policy

Advertiser Disclosure: Forexfinviz.com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.g. exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here's how we make money:.

Disclaimer: It is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While Forexfinviz.com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by Forexfinviz.com , nor shall it bias our reviews, analysis, and opinions. Please see our General Disclaimers for more information.